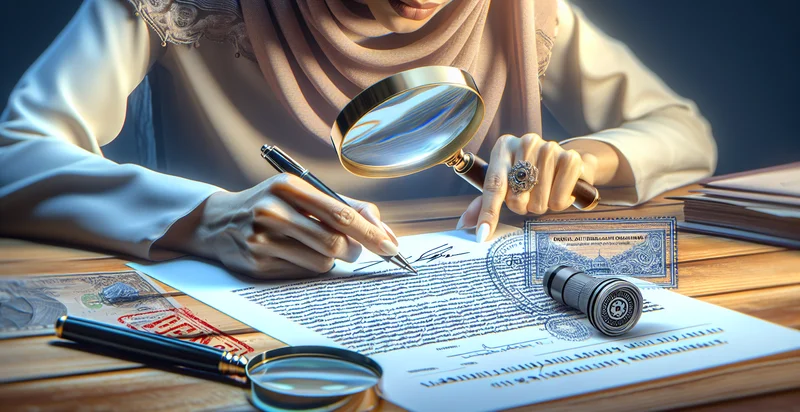

Identify signature verification

using AI

Below is a free classifier to identify signature verification. Just upload your image, and our AI will predict if a signature is genuine or forged. - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("signature-verification", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/signature-verification/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/signature-verification/invoke

How this classifier works

To start, upload your image. Our AI tool will then predict if a signature is genuine or forged..

This pretrained image model uses a Nyckel-created dataset and has 20 labels, including Accepted, Admissible, Ambiguous, Authentic, Contradictory, Counterfeit, Disputed, Forged, Genuine and Inadmissible.

We'll also show a confidence score (the higher the number, the more confident the AI model is around if a signature is genuine or forged.).

Whether you're just curious or building signature verification detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify signature verification at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Bank Loan Applications: Banks can utilize signature verification to authenticate documents submitted with loan applications, reducing the risk of fraud. By analyzing the signatures on financial documents, institutions can ensure that they are genuine and that the applicant is who they claim to be.

- Contract Signing: Businesses can integrate signature verification into the contract signing process to verify the authenticity of signatories. This application helps to protect against forgery, ensuring that contracts are only binding when signed by appropriate individuals.

- Digital Payment Transactions: Online payment systems can employ signature verification to confirm the identity of users during high-value transactions. This adds an extra layer of security, helping to prevent unauthorized access and fraudulent activities.

- Legal Document Validation: Law firms can use signature verification to authenticate important legal documents such as wills, trusts, and property deeds. By ensuring that these documents are signed by the correct parties, legal professionals can maintain the integrity of their services and protect their clients' interests.

- Healthcare Patient Records: Healthcare providers can implement signature verification to ensure that patient consent forms and medical records have been authentically signed. This is crucial for maintaining compliance with regulations, as well as for safeguarding patient data and rights.

- E-Government Services: Government agencies can adopt signature verification in their e-government initiatives to validate citizen interactions. This ensures that applications for permits, licenses, or benefits are processed securely, minimizing the risk of identity theft and fraudulent claims.

- Insurance Claims Processing: Insurance companies can utilize signature verification to authenticate claims forms submitted by policyholders. This helps detect potential fraud at early stages in the claims process, ensuring that payouts are made only for legitimate claims while protecting company assets.