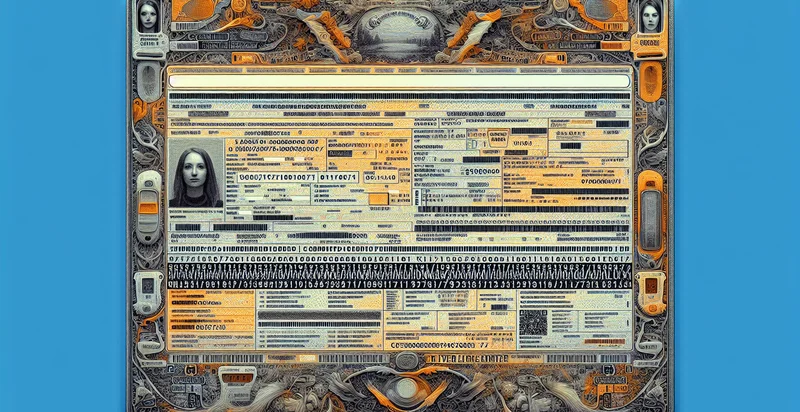

Identify policy number clarity

using AI

Below is a free classifier to identify policy number clarity. Just upload your image, and our AI will predict the clarity of your policy number - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("policy-number-clarity", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/policy-number-clarity/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/policy-number-clarity/invoke

How this classifier works

To start, upload your image. Our AI tool will then predict the clarity of your policy number.

This pretrained image model uses a Nyckel-created dataset and has 10 labels, including Blurred, Clear, Complete, Confusing, Faded, Illegible, Legible, Missing, Partially Clear and Unreadable.

We'll also show a confidence score (the higher the number, the more confident the AI model is around the clarity of your policy number).

Whether you're just curious or building policy number clarity detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify policy number clarity at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Insurance Claim Verification: This function can be utilized by insurance companies to verify the accuracy of policy numbers on submitted claim documents. By identifying and clarifying policy numbers, it ensures that claims are processed against the correct policies, reducing the likelihood of fraud and errors.

- Customer Service Automation: Integrating the identifier into customer service platforms can enable automated assistance for policy inquiries. It allows customers to receive immediate responses regarding their policy details by clearly identifying policy numbers from user-provided documents or messages.

- Data Entry Accuracy Improvement: Businesses can employ this function to enhance the accuracy of data entry processes where policy numbers are involved. By automating the identification of policy numbers in documentation, it minimizes human error and streamlines the data management workflow.

- Fraud Detection: The identifier can serve as a tool for detecting fraudulent activities by verifying the authenticity of policy numbers submitted in various transactions. By cross-referencing identified policy numbers within databases, companies can flag potentially fraudulent submissions for further investigation.

- Compliance Audits: Organizations can use the policy number clarity identifier during compliance audits to ensure that all documentation is accurate and in order. This function can help auditors confirm that all policies are correctly cataloged and accounted for, enhancing regulatory compliance.

- Customer Policy Updates: Insurance providers can leverage this function for processing customer requests for policy changes. By accurately identifying existing policy numbers, the system can facilitate seamless updates and modifications to customer accounts, improving operational efficiency.

- Marketing Analytics: The identifier can be used in marketing analytics to segment customers based on their policy types and statuses. By clarifying policy numbers, companies can analyze customer data more effectively, enabling targeted marketing campaigns tailored to specific customer segments.