Identify letter security features

using AI

Below is a free classifier to identify letter security features. Just upload your image, and our AI will predict what security features are present on the letter - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("letter-security-features", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/letter-security-features/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/letter-security-features/invoke

How this classifier works

To start, upload your image. Our AI tool will then predict what security features are present on the letter.

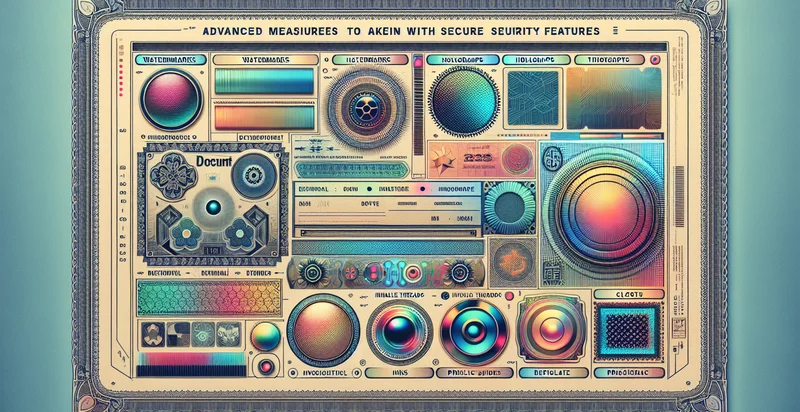

This pretrained image model uses a Nyckel-created dataset and has 25 labels, including Anti-Copy Feature, Barcode, Color Shifting Ink, Digital Signature, Embedded Chip, Embossing, Fingerprint, Foil Stamping, Hologram and Invisible Ink.

We'll also show a confidence score (the higher the number, the more confident the AI model is around what security features are present on the letter).

Whether you're just curious or building letter security features detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify letter security features at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Fraud Prevention in Financial Institutions: Financial institutions can utilize the 'letter security features' identifier to detect fake letters or documents submitted by customers. By identifying fraudulent security features in correspondence, they can reduce the risk of identity theft and unauthorized transactions.

- Automated Mail Screening: Companies receiving large volumes of mail can implement this function to automate the scanning of incoming letters for security features. This can help identify suspicious or potentially harmful communications before they reach sensitive departments.

- Government Document Verification: Government agencies can use the identifier to verify the authenticity of official documents, such as tax returns or immigration papers. This ensures that submissions meet regulatory standards and helps streamline processing times.

- Consumer Safety in E-commerce: E-commerce platforms can adopt the function to evaluate and authenticate the security features of letters sent as part of promotional campaigns or official notifications. This protects consumers from scams and enhances brand credibility.

- Insurance Claim Validation: Insurance companies can leverage the identifier to verify documents submitted as part of a claim process, ensuring that the letters have authentic security features. This can help prevent fraudulent claims and save significant amounts in payouts.

- Secure Communication in Legal Firms: Law firms can utilize the 'letter security features' identifier to authenticate correspondence and documents exchanged with clients or other legal entities. By verifying security features, firms can enhance their confidentiality and trustworthiness.

- Quality Control in Mailing Services: Mailing services companies can implement the identifier to perform quality checks on outgoing letters, ensuring that security features are correctly applied. This minimizes instances of non-compliance and enhances customer satisfaction through reliable mail delivery.