Identify insurance brands

using AI

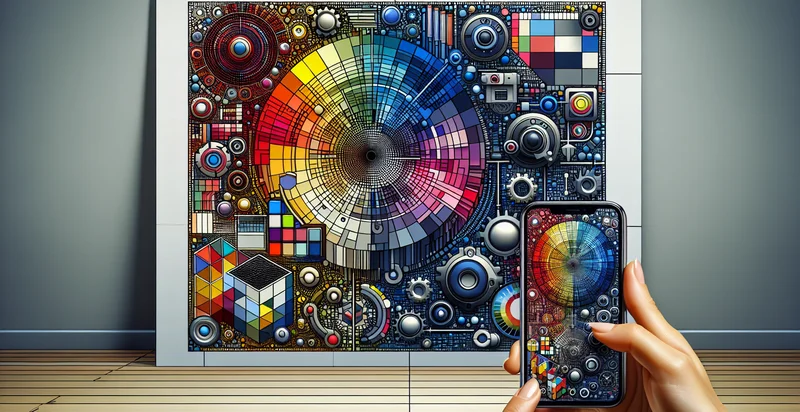

Below is a free classifier to identify insurance brands. Just upload your image, and our AI will predict what type of insurance brand it is - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("insurance-brands", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/insurance-brands/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/insurance-brands/invoke

How this classifier works

To start, upload your image. Our AI tool will then predict what type of insurance brand it is.

This pretrained image model uses a Nyckel-created dataset and has 24 labels, including Aetna, Aig, Allianz, American Family, Assurant, Axis Insurance, Blue Cross Blue Shield, Chubb, Cigna and Farmers.

We'll also show a confidence score (the higher the number, the more confident the AI model is around what type of insurance brand it is).

Whether you're just curious or building insurance brands detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify insurance brands at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Brand Detection in Claims Processing: This feature can automatically identify the insurance brand associated with images submitted in claims, streamlining the verification process. By quickly classifying images, insurers can enhance the efficiency of claim approvals.

- Marketing Analysis for Competitor Brands: Utilizing this classification function, marketing teams can analyze social media images to determine which insurance brands are being discussed or featured. This can provide insights into brand perception and competitive positioning within the industry.

- Fraud Detection in Policyholder Submissions: The image classifier can play a vital role in identifying false claims by recognizing discrepancies in brand usage within submitted images. For example, if a policyholder submits an image that falsely advertises an insurance product, the system can flag it for further investigation.

- Insurance Brand Compliance Monitoring: Insurance companies can use this function to ensure that promotional materials or customer communications adhere to brand guidelines. By automatically classifying images, the system can detect any unauthorized use of brand logos or materials in communications.

- Customer Segmentation Based on Insurance Brand Affinity: By analyzing customer-uploaded images, the classification tool can assist in understanding consumer preferences for specific insurance brands. This information can be vital for targeted marketing campaigns and personalized service offerings.

- Training and Development for Claims Adjusters: The classifier can be utilized in training sessions for claims adjusters, providing them with annotated images of different insurance brands. This can help improve their ability to recognize legitimate submissions and identify potential risks.

- Enhancing User Experience on Insurance Platforms: Implementing this function on user-facing platforms can help guide users in selecting the right insurance brand based on visual prompts and suggestions. By classifying images correctly, users can receive personalized recommendations, improving satisfaction and engagement with the platform.