Identify if check is voided

using AI

Below is a free classifier to identify if check is voided. Just upload your image, and our AI will predict if the check is voided - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("if-check-is-voided", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/if-check-is-voided/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/if-check-is-voided/invoke

How this classifier works

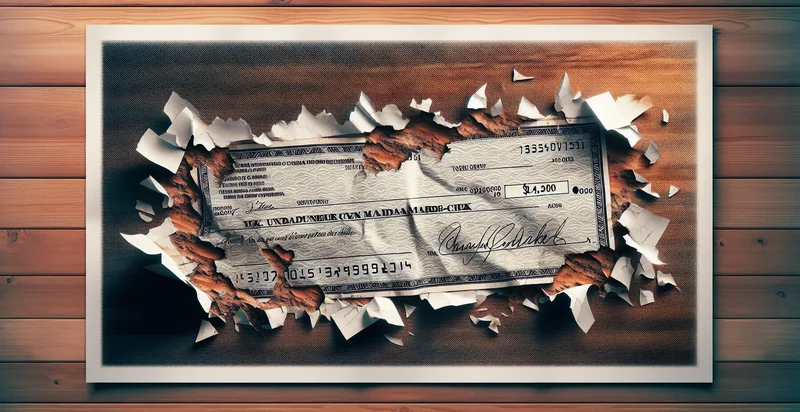

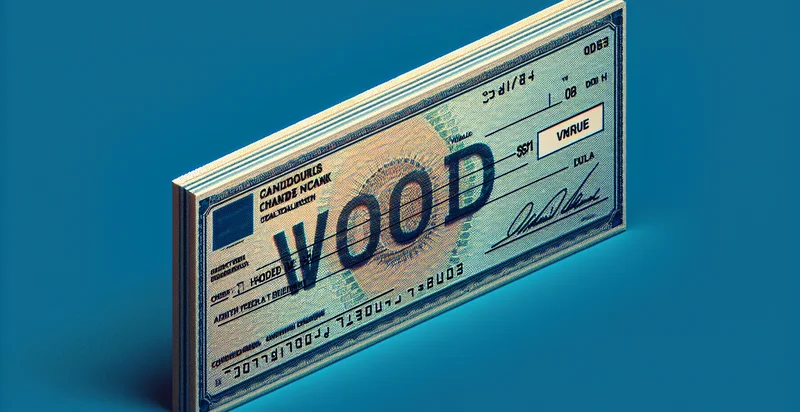

To start, upload your image. Our AI tool will then predict if the check is voided.

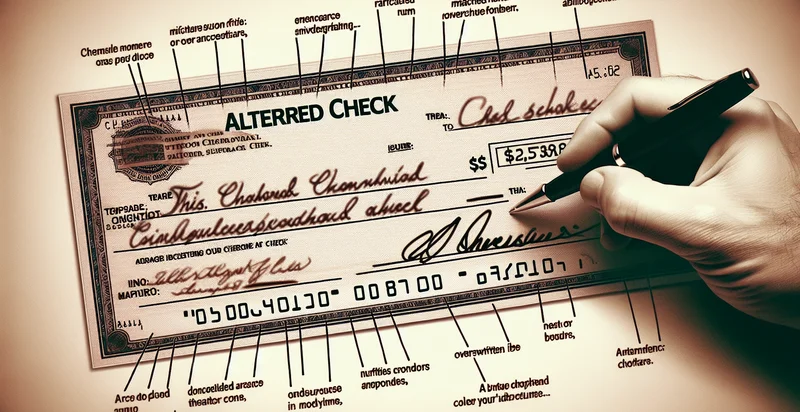

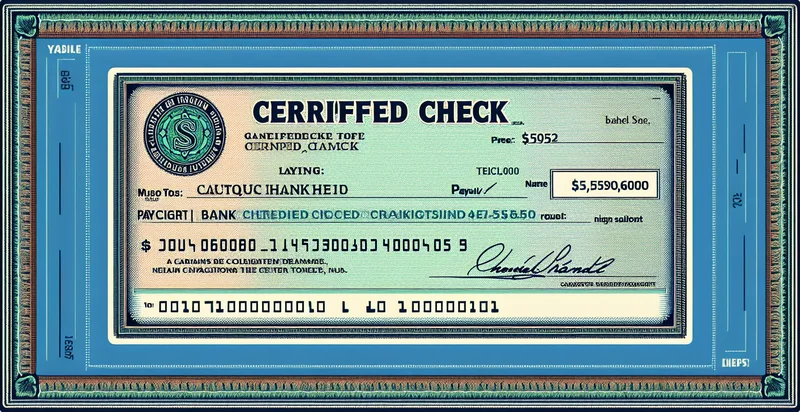

This pretrained image model uses a Nyckel-created dataset and has 2 labels, including Valid and Voided.

We'll also show a confidence score (the higher the number, the more confident the AI model is around if the check is voided).

Whether you're just curious or building if check is voided detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify if check is voided at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Fraud Detection: This use case applies to financial institutions that need to identify potentially fraudulent activities related to voided checks. By implementing the image classification function, banks can automatically flag any voided check that appears suspicious, allowing for quicker investigation and reduction of fraudulent losses.

- Improved Customer Service: Retailers can enhance their customer service by automatically processing and identifying voided checks during transaction disputes. Instead of manually verifying void status, automated classification expedites resolution, ensuring a smoother customer experience and faster refunds.

- Compliance Monitoring: Financial regulatory bodies can use the image classification function to monitor voided checks passed through financial institutions. This helps ensure compliance with anti-money laundering processes and can aid in the prevention of check kiting or other illegal practices.

- Accounting Accuracy: Companies can integrate this function to automate the reconciliation of voided checks in their accounting systems. By accurately identifying voided checks, organizations can maintain financial integrity and reduce the risk of accounting errors.

- Streamlined Audit Processes: During audits, firms can utilize the classification function to efficiently sort and identify voided checks in historical records. This streamlined process saves time for auditors and improves the overall accuracy of financial reviews.

- Transaction Analysis: Businesses can employ the True image classification function to analyze patterns in voided check submissions over time. Through this data analysis, they may discover insights into reasons for voids, leading to improved operational practices and reduced incidences of voided transactions.

- Enhanced Data Management: Organizations can improve their data management practices by automating the tagging and storage of voided checks. This ensures that voided checks are accurately archived and easily retrievable, assisting in transparency and data integrity efforts.