Identify if check is damaged

using AI

Below is a free classifier to identify if check is damaged. Just upload your image, and our AI will predict if the check is damaged - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("if-check-is-damaged", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/if-check-is-damaged/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/if-check-is-damaged/invoke

How this classifier works

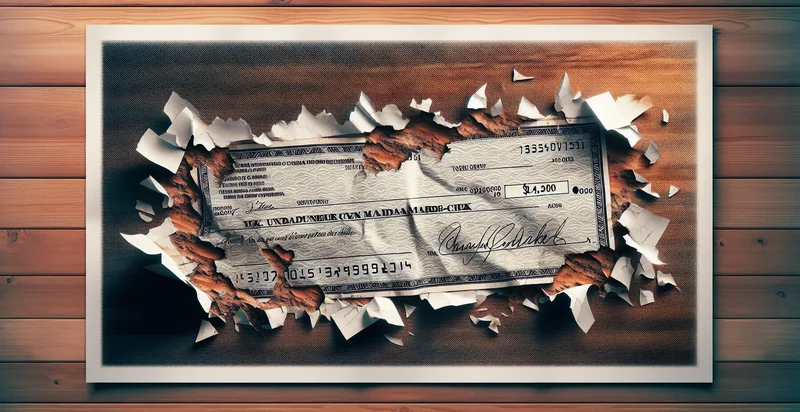

To start, upload your image. Our AI tool will then predict if the check is damaged.

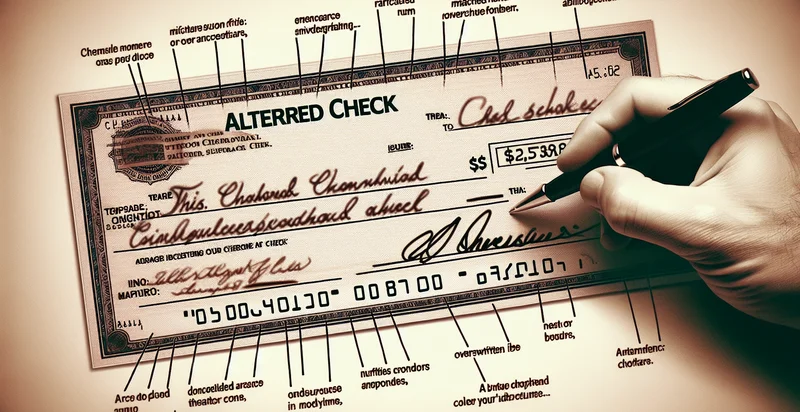

This pretrained image model uses a Nyckel-created dataset and has 2 labels, including Damaged and Intact.

We'll also show a confidence score (the higher the number, the more confident the AI model is around if the check is damaged).

Whether you're just curious or building if check is damaged detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify if check is damaged at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Automated Check Processing: Banks and financial institutions can integrate the 'if check is damaged' identifier into their check processing systems. This would enable automatic rejection of damaged checks, reducing the time and labor involved in manual inspections and improving operational efficiency.

- Fraud Detection: Retailers that accept checks can utilize the identifier to flag potentially fraudulent checks that show signs of damage, such as alterations or irregular wear. This proactive measure helps mitigate losses from check fraud and enhances overall security in transactions.

- Insurance Claims Assessment: Insurance companies can apply the image classification function to assess checks submitted as part of claims in a more efficient manner. By identifying damaged checks, they can streamline the claims process and reduce the risk of processing invalid claims due to check issues.

- Quality Control in Check Printing: Check printing companies can implement the identifier within their production line to ensure that only checks in pristine condition are sent out. This quality control measure can enhance customer satisfaction and reduce the volume of returned or reissued checks.

- Customer Service Automation: Financial institutions can automate customer inquiries related to check deposits or rejections by integrating the identifier into their support systems. If a check is identified as damaged, automated responses can guide customers through the next steps, improving service speed and effectiveness.

- Inventory Management for Banking Operations: Banks can utilize the identifier as part of their inventory management system for check supplies. By monitoring and flagging damaged checks in real-time, they can ensure they maintain healthy inventory levels of usable checks for customer transactions.

- Regulatory Compliance: Financial institutions need to comply with various regulations regarding check processing and fraud prevention. Using the damaged check identifier can help ensure that processes are aligned with compliance requirements by minimizing the risk associated with accepting potentially invalid checks.