Identify if check is certified

using AI

Below is a free classifier to identify if check is certified. Just upload your image, and our AI will predict if the check is certified - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("if-check-is-certified", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/if-check-is-certified/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/if-check-is-certified/invoke

How this classifier works

To start, upload your image. Our AI tool will then predict if the check is certified.

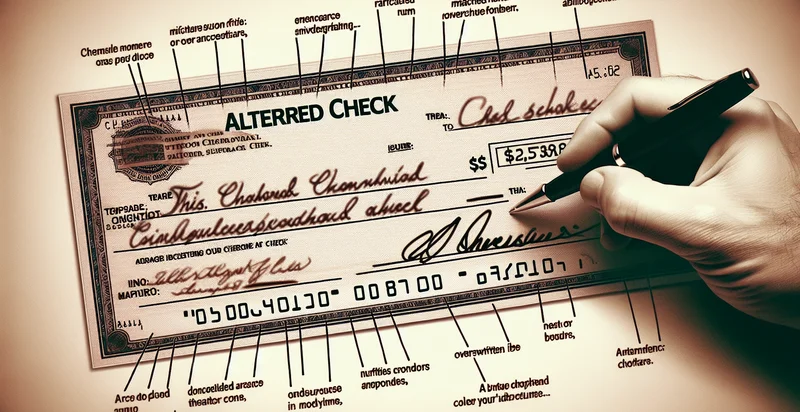

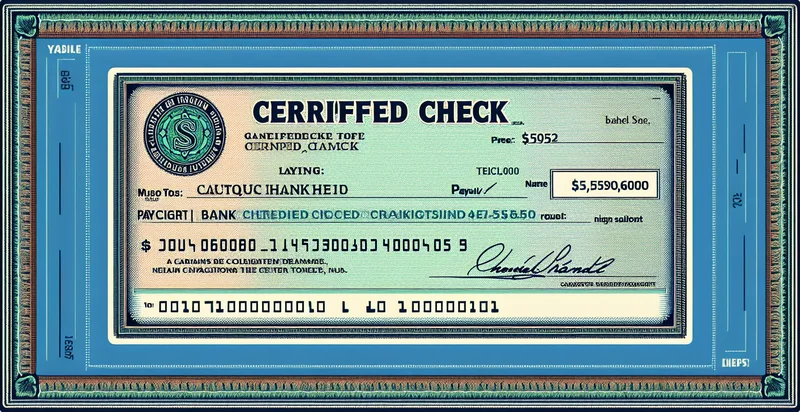

This pretrained image model uses a Nyckel-created dataset and has 2 labels, including Certified and Regular.

We'll also show a confidence score (the higher the number, the more confident the AI model is around if the check is certified).

Whether you're just curious or building if check is certified detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify if check is certified at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Fraud Prevention in Banking: Financial institutions can utilize the 'if check is certified' identifier to verify the authenticity of checks before processing payments. By automating this process, banks can significantly reduce the risk of fraud and protect their customers' accounts from illicit activity.

- Insurance Claims Validation: Insurance companies can implement this function to ensure that checks submitted for claims are legitimate. This helps in minimizing fraudulent claims by cross-referencing the certification status of checks against their records, ensuring payouts are made only on valid claims.

- Point of Sale Transactions: Retailers can leverage this identifier to assess check authenticity at the point of sale. By confirming whether a check is certified, they can speed up the payment process and decrease the likelihood of accepting counterfeit checks.

- Government Assistance Programs: Government agencies can use the 'if check is certified' function to authenticate checks issued for social welfare or unemployment benefits. Ensuring that checks are certified helps prevent financial abuse and ensures aid goes to genuine beneficiaries.

- Contractor Payment Verification: Construction companies can apply this identifier to verify payments made to contractors. By ensuring that checks are certified before disbursement, companies can safeguard against payment fraud and ensure that contractors meet regulations before funding.

- E-Commerce Refunds: E-commerce platforms can utilize the identifier to validate checks issued for customer refunds. This function allows businesses to ensure that refunded amounts are processed securely, reducing the risk of refund-related fraud.

- Payroll Processing: Companies can implement the 'if check is certified' function to validate payroll checks before distribution. By ensuring checks are certified, businesses can mitigate the risk of issuing checks that could be fraudulent, safeguarding employees' salaries.