Identify if check is altered

using AI

Below is a free classifier to identify if check is altered. Just upload your image, and our AI will predict if the check is altered - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("if-check-is-altered", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/if-check-is-altered/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/if-check-is-altered/invoke

How this classifier works

To start, upload your image. Our AI tool will then predict if the check is altered.

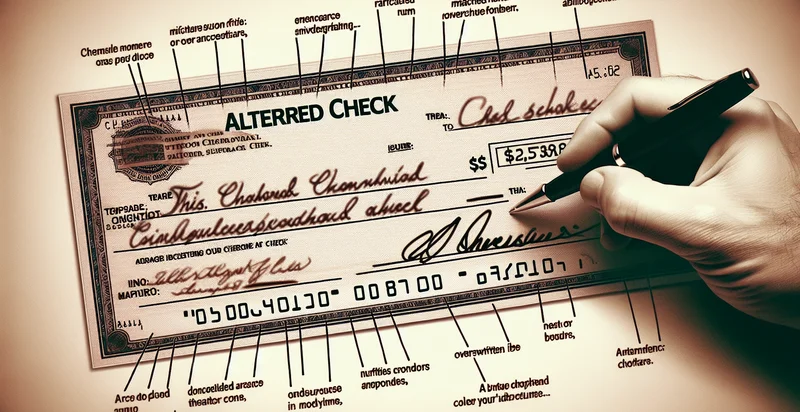

This pretrained image model uses a Nyckel-created dataset and has 2 labels, including Altered and Original.

We'll also show a confidence score (the higher the number, the more confident the AI model is around if the check is altered).

Whether you're just curious or building if check is altered detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify if check is altered at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Fraud Detection in Banking: This use case focuses on the identification of altered checks to prevent financial fraud. By utilizing the image classification function, banks can automate the verification process, flagging any checks that appear to have been tampered with, thus enhancing security measures for both institutions and customers.

- Insurance Claim Verification: Insurance companies can employ this function to authenticate checks submitted as part of claims payments. By detecting alterations in check images, insurers can reduce the risk of fraudulent claims and ensure that payments are made only for legitimate damages.

- Automated Accounts Payable: Businesses in accounts payable can integrate the function to streamline their payment processing. By identifying altered checks, companies can mitigate payment errors and a potential loss of funds due to fraudulent manipulation.

- Payment Processing for E-commerce: E-commerce platforms that accept checks can utilize this classification function to verify the integrity of payments. This will help them ensure that only valid, unaltered checks are accepted, thereby improving the reliability of transaction processing.

- Compliance and Audit Support: Organizations can implement this function to support compliance efforts in their financial processes. By identifying altered checks, businesses can maintain accurate records and support audits by ensuring that all financial transactions are legitimate.

- Check Printing Integrity: Companies that print their own checks can use this function to verify the integrity of printed checks before distribution. By ensuring that no alterations have occurred, businesses can reduce errors and potential fraud in their payment systems.

- Financial Risk Assessment: Risk management departments can leverage this image classification function to assess the integrity of checks related to high-risk transactions. Detecting alterations can help organizations identify potential fraud early on, leading to better risk mitigation strategies and enhanced due diligence practices.