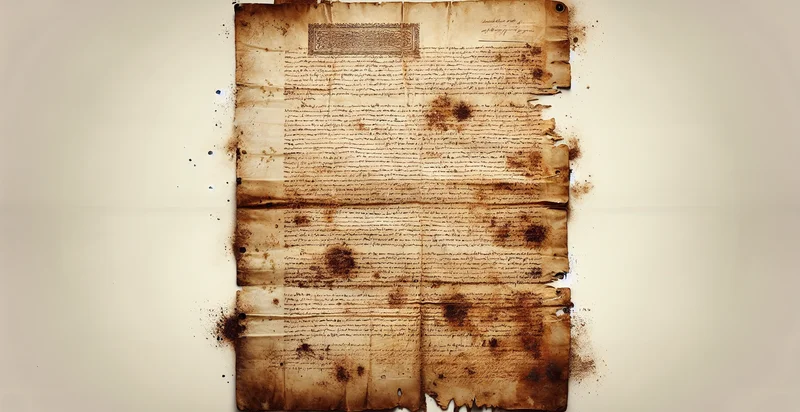

Identify if a document is ineligible

using AI

Below is a free classifier to identify if a document is ineligible. Just upload your image, and our AI will predict if a document is ineligible - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("if-a-document-is-ineligible", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/if-a-document-is-ineligible/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/if-a-document-is-ineligible/invoke

How this classifier works

To start, upload your image. Our AI tool will then predict if a document is ineligible.

This pretrained image model uses a Nyckel-created dataset and has 2 labels, including Eligible Document and Ineligible Document.

We'll also show a confidence score (the higher the number, the more confident the AI model is around if a document is ineligible).

Whether you're just curious or building if a document is ineligible detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify if a document is ineligible at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Loan Application Screening: The 'if a document is ineligible' identifier can automatically analyze loan applications to determine if submitted documents meet eligibility criteria. This reduces manual review time and improves the efficiency of processing applications, allowing lenders to focus on valid submissions.

- Insurance Claim Processing: In the insurance industry, this classification function can identify ineligible documents submitted with claims, such as expired policies or incomplete forms. By flagging these documents, claims adjusters can expedite their decision-making processes and reduce turnaround times for valid claims.

- Compliance Documentation Review: Financial institutions can utilize this function to screen compliance-related documents for eligibility. This ensures that only documents that meet regulatory requirements are processed, minimizing the risk of non-compliance and potential penalties.

- Human Resource Recruitment: HR departments can leverage this identifier to assess job application submissions for ineligible documents like invalid certifications or missing references. This speeds up the recruitment process by helping HR focus on candidates who meet all necessary qualifications.

- Education Enrollment Verification: Educational institutions can use this feature to verify the eligibility of documents submitted for enrollment, such as transcripts or recommendation letters. Ensuring that only valid documents are accepted enhances the integrity of the admissions process and helps maintain academic standards.

- Healthcare Eligibility Checks: Healthcare organizations can employ this function to verify the eligibility of patient documents before processing insurance claims. By identifying and rejecting ineligible documents early, providers can reduce claim denials and improve their revenue cycle management.

- Real Estate Transaction Processing: In real estate, the identifier can be implemented to review documents involved in property transactions, such as contracts and identification proofs. This ensures that all documentation complies with legal standards, reducing potential disputes and closing delays.