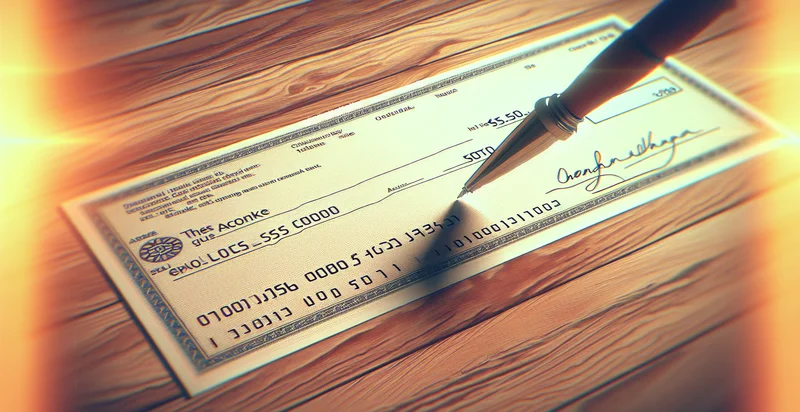

Identify check amount legibility

using AI

Below is a free classifier to identify check amount legibility. Just upload your image, and our AI will predict the legibility of check amounts - in just seconds.

Contact us for API access

Or, use Nyckel to build highly-accurate custom classifiers in just minutes. No PhD required.

Get started

import nyckel

credentials = nyckel.Credentials("YOUR_CLIENT_ID", "YOUR_CLIENT_SECRET")

nyckel.invoke("check-amount-legibility", "your_image_url", credentials)

fetch('https://www.nyckel.com/v1/functions/check-amount-legibility/invoke', {

method: 'POST',

headers: {

'Authorization': 'Bearer ' + 'YOUR_BEARER_TOKEN',

'Content-Type': 'application/json',

},

body: JSON.stringify(

{"data": "your_image_url"}

)

})

.then(response => response.json())

.then(data => console.log(data));

curl -X POST \

-H "Content-Type: application/json" \

-H "Authorization: Bearer YOUR_BEARER_TOKEN" \

-d '{"data": "your_image_url"}' \

https://www.nyckel.com/v1/functions/check-amount-legibility/invoke

How this classifier works

To start, upload your image. Our AI tool will then predict the legibility of check amounts.

This pretrained image model uses a Nyckel-created dataset and has 10 labels, including Clear, Completely Illegible, Difficult To Read, Illegible, Not Readable, Partially Clear, Readable, Somewhat Clear, Unclear and Very Clear.

We'll also show a confidence score (the higher the number, the more confident the AI model is around the legibility of check amounts).

Whether you're just curious or building check amount legibility detection into your application, we hope our classifier proves helpful.

Related Classifiers

Need to identify check amount legibility at scale?

Get API or Zapier access to this classifier for free. It's perfect for:

- Document Verification: The 'check amount legibility' identifier can be employed by financial institutions to automatically validate the legibility of amounts written on checks. This ensures that all checks processed are clear and unambiguous, reducing the risk of errors and fraud.

- Insurance Claim Processing: Insurance companies can utilize the function to assess the legibility of monetary amounts on claim forms. This aids in speeding up the claim processing time and ensures accurate payouts based on clearly legible information.

- Invoice Management: Organizations can integrate this identifier into their accounts payable software to ensure that the amounts on incoming invoices are readable. This minimizes discrepancies between invoiced and paid amounts, enhancing financial accuracy and streamlining payment processes.

- Retail Transaction Analysis: Retailers can implement this function at checkout to verify the amounts on handwritten receipts or coupons. By confirming legibility in real-time, the risk of customer disputes over unclear amounts is significantly reduced.

- Government Aid Applications: Government agencies can utilize the identifier to improve the processing of aid applications where financial disclosure is required. This ensures that all reported amounts are legible, thus enabling accurate assessment of eligibility and funding.

- E-commerce Return Processing: Online retailers can apply this function to evaluate the clarity of amounts on returned product labels. This helps ensure that refunds are processed quickly and accurately, leading to increased customer satisfaction and reduced operational delays.

- Loan Documentation: Banks can use this identifier for reviewing loan applications that include handwritten financial declarations. By ensuring that all monetary amounts are legible, the institution can make informed lending decisions quickly and reduce the likelihood of processing errors.